Elevating International Students' Financial Journey

Research, Ideation, Prototype, Testing, UI/UX

As a part of my master’s program, students were divided into teams of five and assigned to work with an industry sponsor. My team worked directly with Deloitte Digital, which aspires to elevate the human experience through their work.

Deloitte came to us with a mission to elevate young people’s experience with money through inclusive design. To do that, we must put vulnerable people at the heart of the design process. We decided to focus on international students leaving home for the first time.

We believe they are vulnerable because…

It’s their first time managing a large sum of money in a foreign country with different currency and price standards.

Transwap (2021)

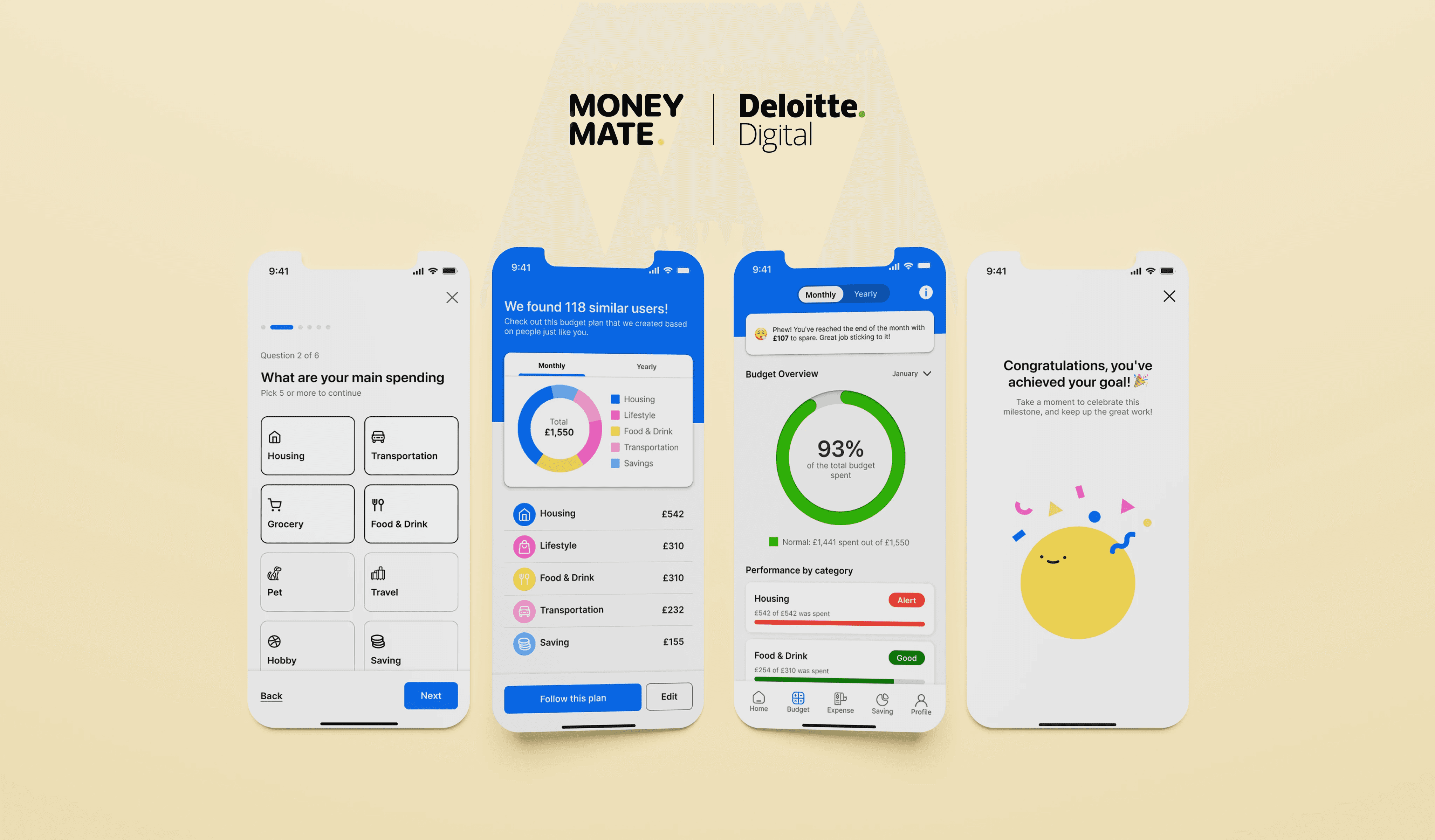

Budgeting made easy

Begin budgeting just by answering a few questions to understand you better!

Get a tailored budget plan based on users similar to you.

Secure your financial future

Get alerted when you spend too fast

Help you understand your finances better, alleviating financial stress.

Prompt long-term planning through the yearly view and goal-setting.

Track expenses in one place

Track your money and feel in control of your finances.

Eliminate the excruciating process of switching between apps to track money.

Discover

Secondary Research

Hunt Statement

Guerilla Interviews

Semi-structured Interviews

Define

Affinity Diagram

Experience Map

Persona Development

Competitor Analysis

Develop

User Flow

Wireframe

Hi-fi Prototype

Feedback Loop

Deliver

WCAG evaluation

SUS assessment

Final Refinement

PROBLEM STATEMENT

HMW design to help people who are leaving home for the first time put good measures in place to practice good financial health?

Three main discovery pillars to answer the problem

Pain points

Current practices

Contextual factors

Starting broad.

Method: Guerilla Interviews

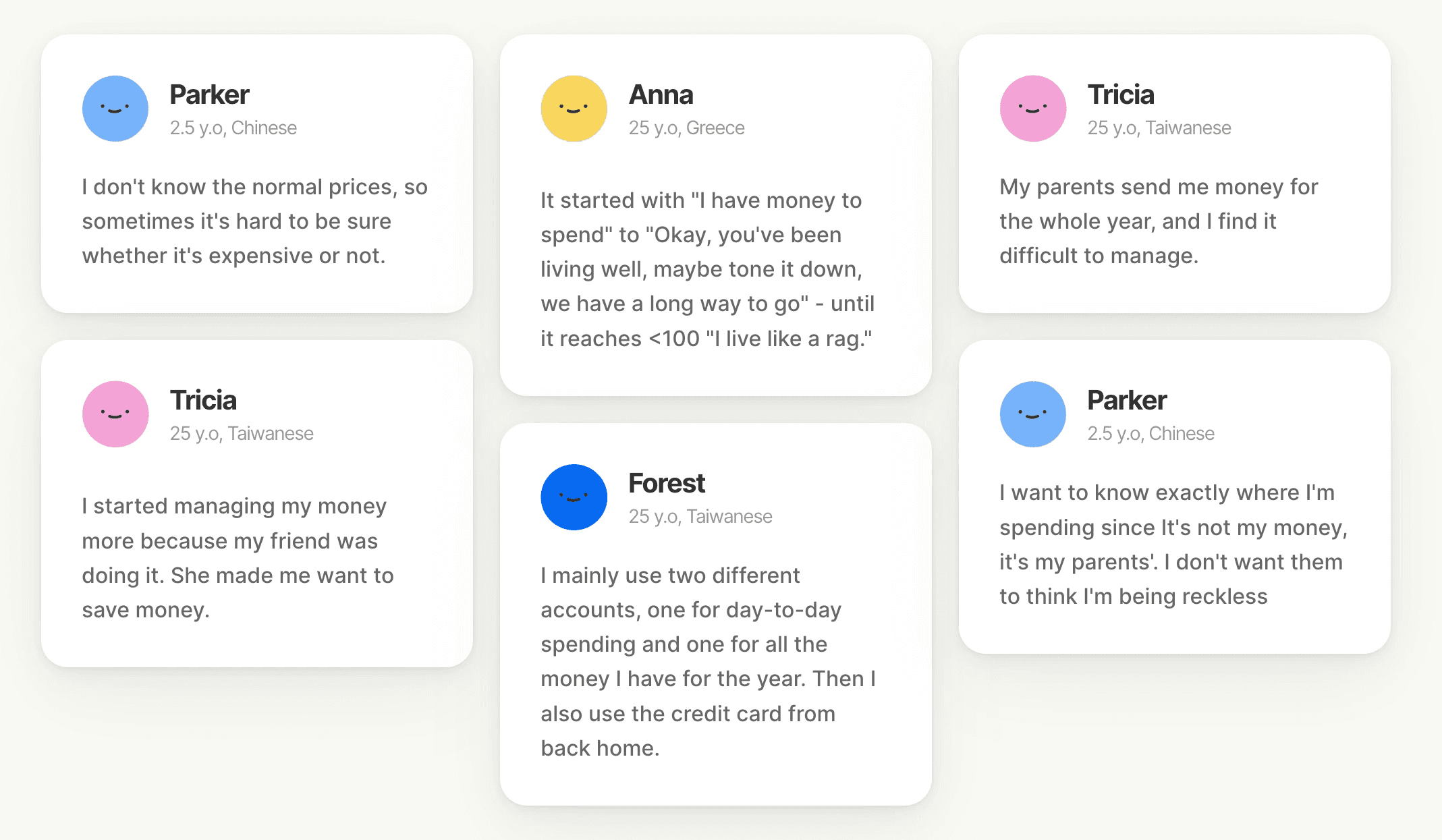

Before narrowing down our research scope, we started broad with guerrilla interviews to avoid bias. We conducted 5 minutes interviews with 15 international students from 8 countries at the university library.

Pain points

33%

Current practices

67%

Contextual factors

3-12

Pain points

40%

We discovered that most pain points occur early during studying abroad.

Narrowing down.

Method: Semi-structured interviews and laddering

Clustering the findings — the story unfolds

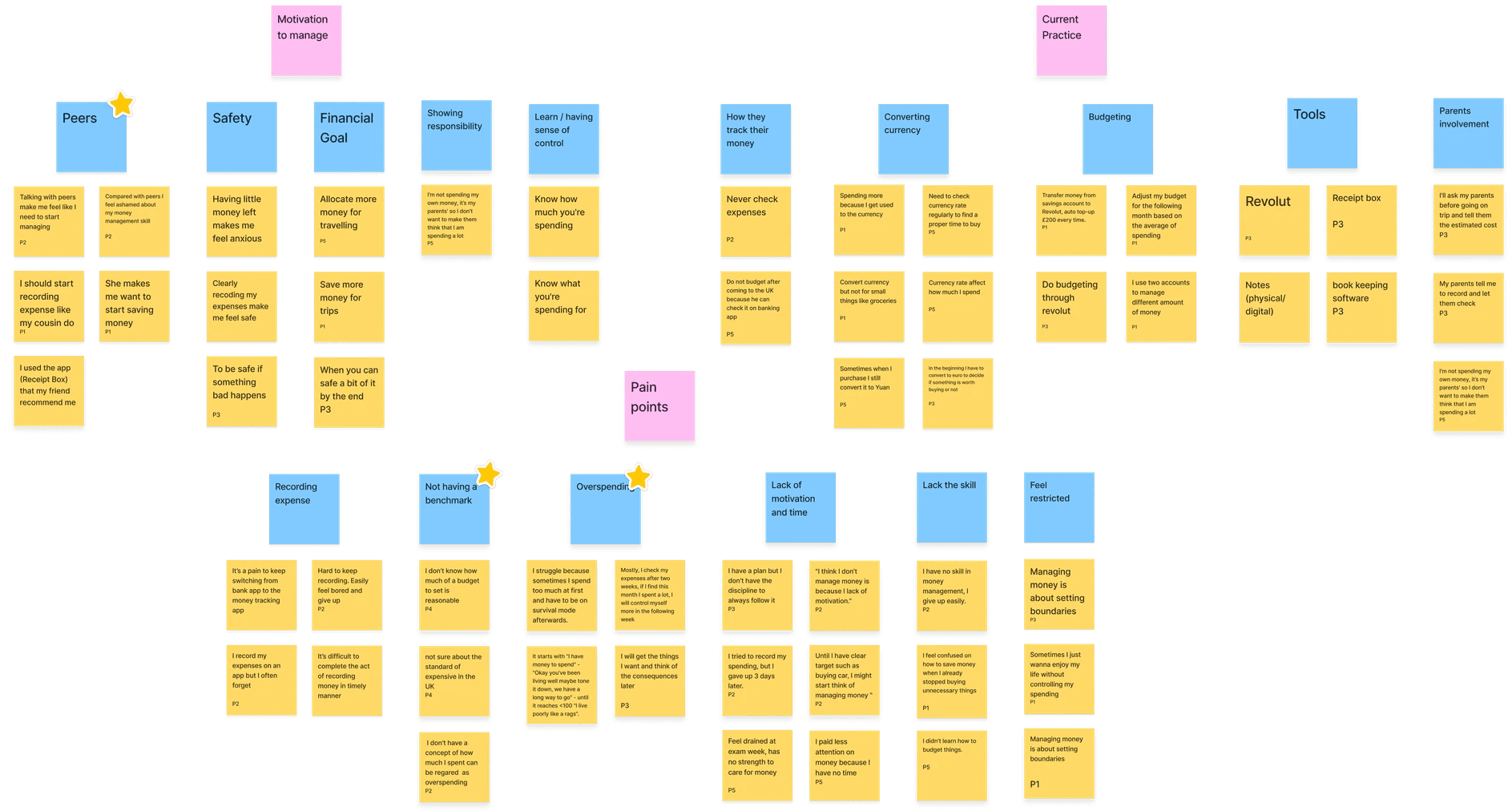

Method: Affinity diagram

We sorted the findings from our research and categorised them to find commonalities before interpreting them. Out of this process, a story emerges about people and their problems.

👀

Financial blindspot

They want to feel assured that their financial decisions are right, but it's hard for them to judge because they're not familiar with local prices.

📅

Short-term thinker

💸

Decentralised finances

Opening bank accounts at different times upon arrival decentralises finances, making tracking money difficult and causing a loss of control.

👭🏻

Peers as benchmark

They see peers as a benchmark and feel a need to catch up, finding reassurance in aligning their financial progress with their peers.

Based on these insights, we believe there is an opportunity to design a product that…

Enables users to make an informed financial plan and understand their finances better to turn spending into a guilt-free experience.

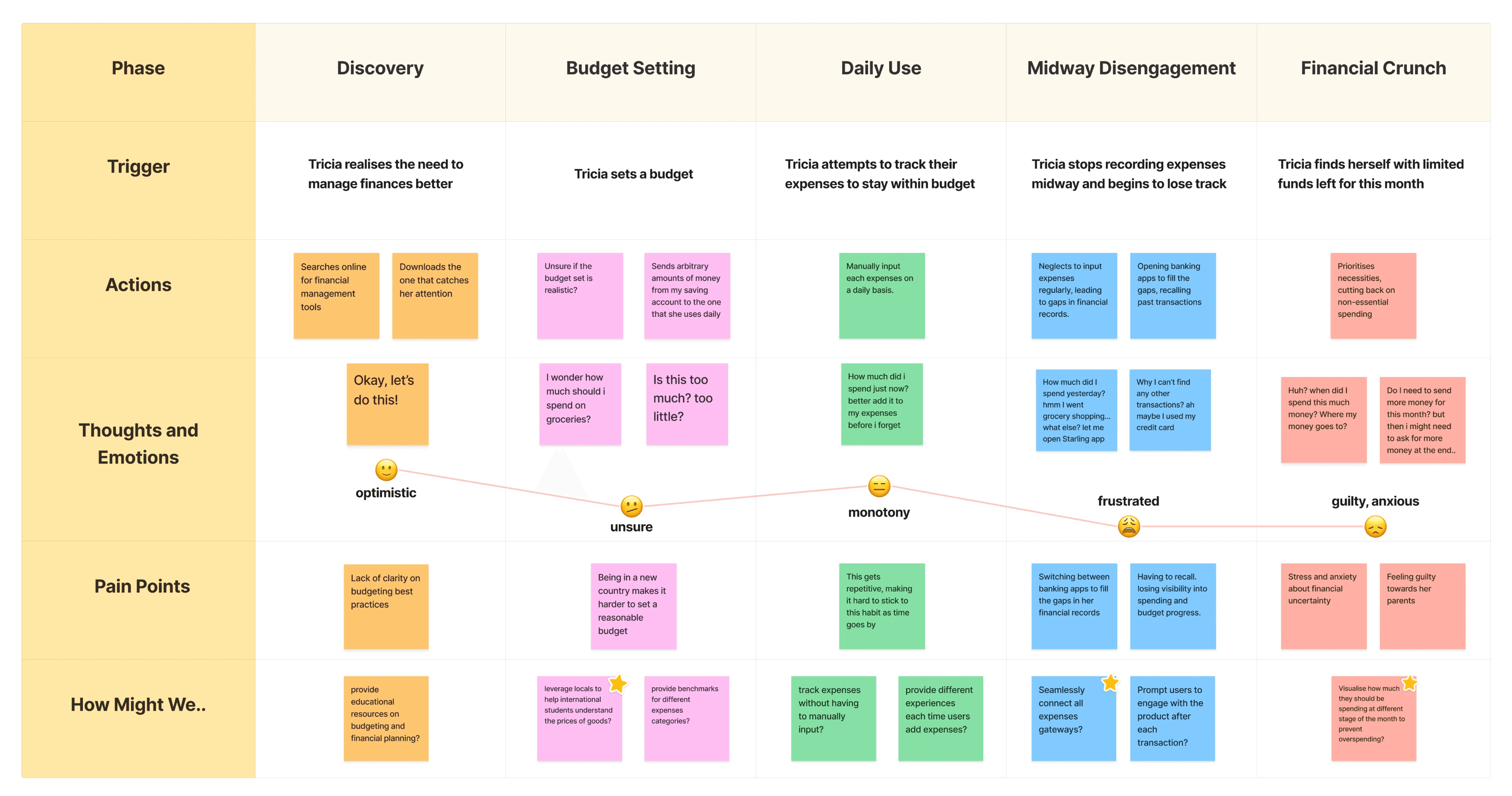

Choosing the right opportunity

The team needs a shared understanding of users' perspectives to make informed decisions collaboratively. Therefore, we created a persona and mapped their experience. We prioritised opportunities that impact the user most, addressing their specific needs.

To begin shaping the product, we conducted a competitor analysis to identify the gap within existing financial tools that our users commonly use — Turning gaps into opportunities.

Nothing on the market addresses users' needs to adjust financially in a new environment

Reimagining the experience

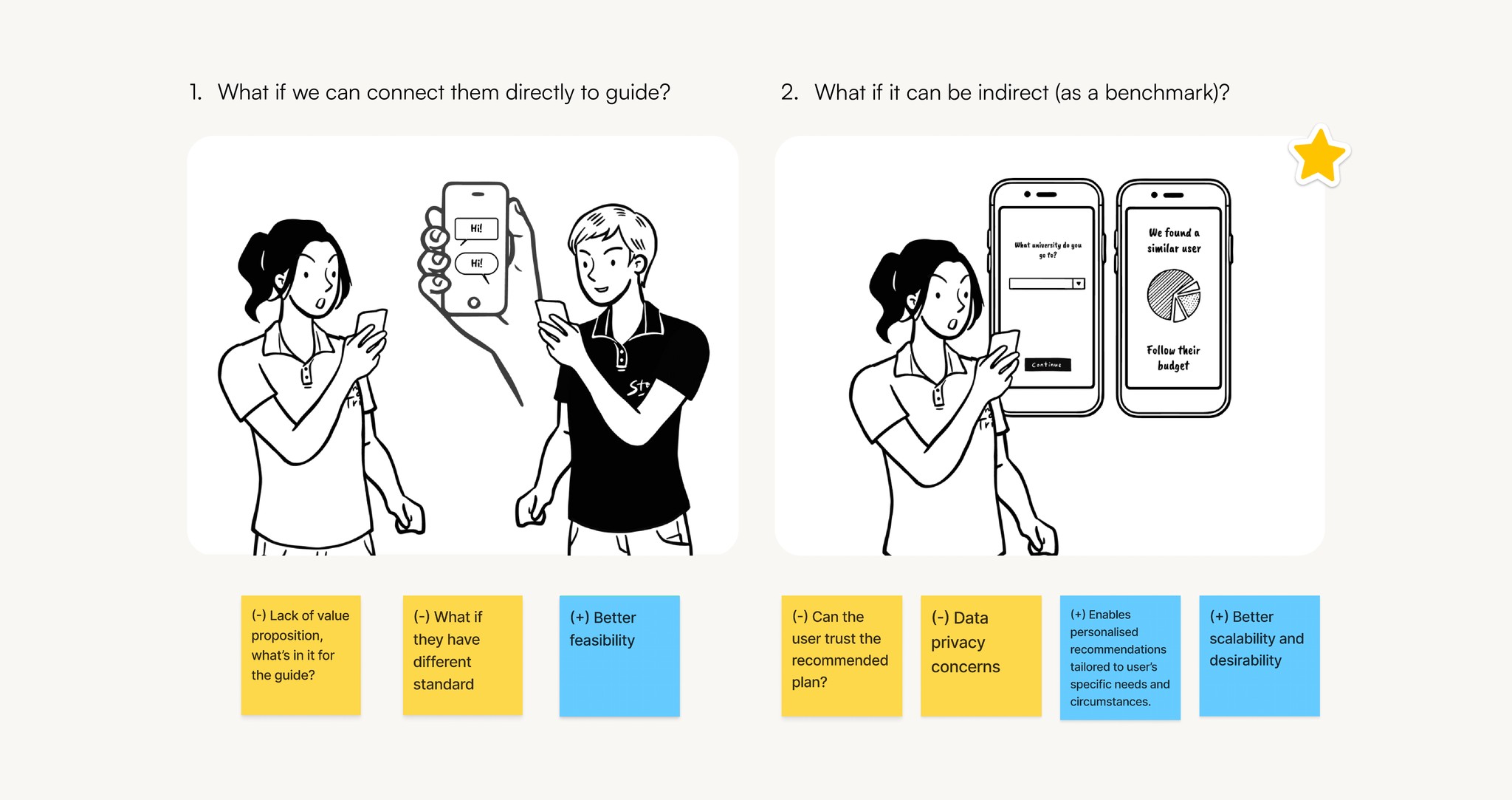

We explored ways that will take us closer to achieving the UX Vision Statement through a brainstorming session. Then, we chose the ones we believe deliver the most value to test.

How might we leverage peers to help international students new to budgeting make informed financial plan?

Involving the user — early

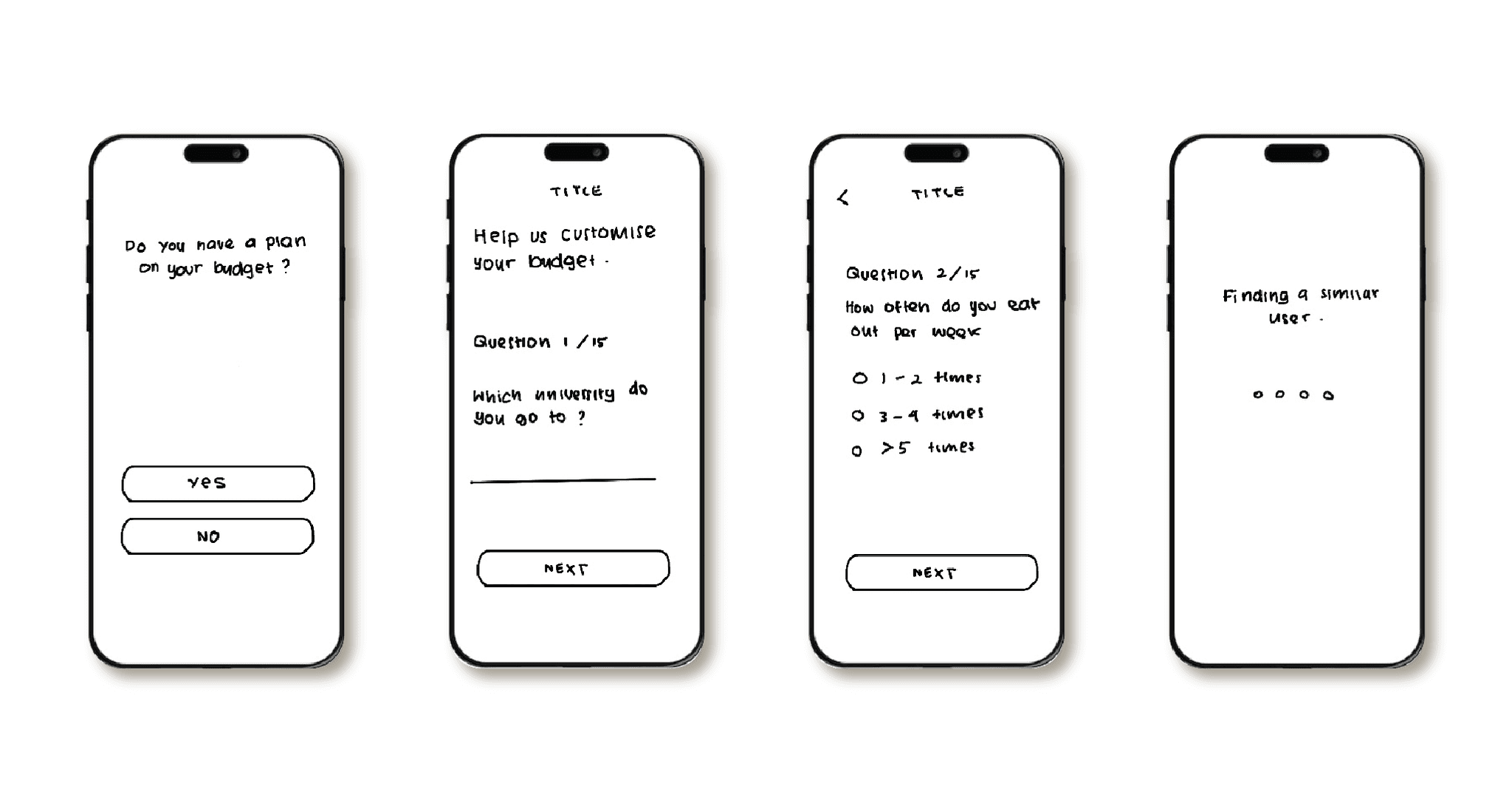

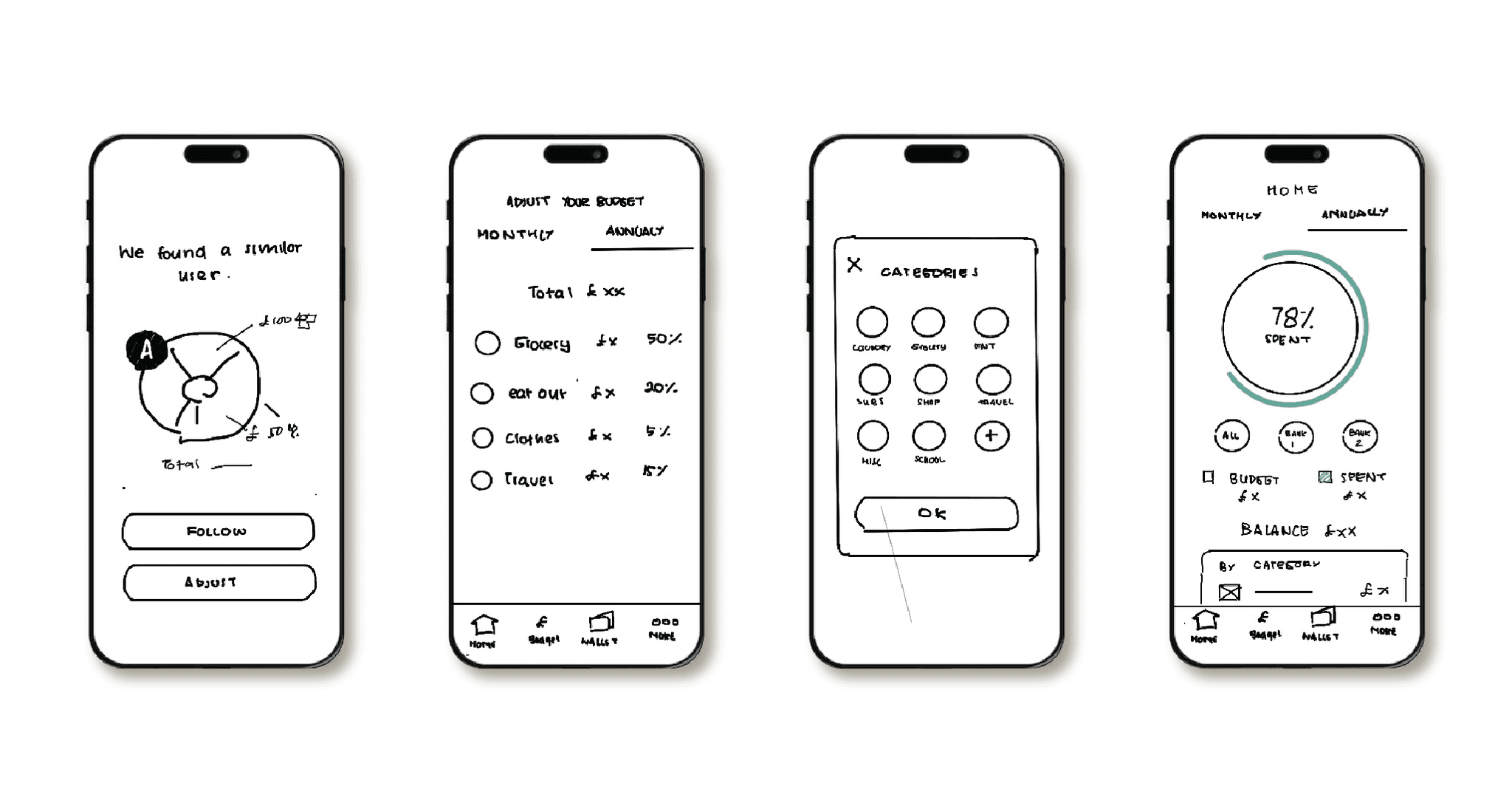

Method: Wireframe and think-aloud protocol

We used wireframes to get users' feedback as early as possible, minimising wasted effort. We walked them through the wireframes and asked them to verbalise their thoughts.

Here's when we faced a problem

3 out of 4 participants would possibly use the product with some adjustments. We then pinpointed the main blockers that hinder users from engaging with the product.

🤝

Lack of reliability

They weren't sure if answering questions and getting a budget plan based on one similar user was enough to get the right plan for them.

🚨

Lack of urgency

The user might not stick to the budget for long if they don't know how well they're doing or what could happen if they don't follow it.

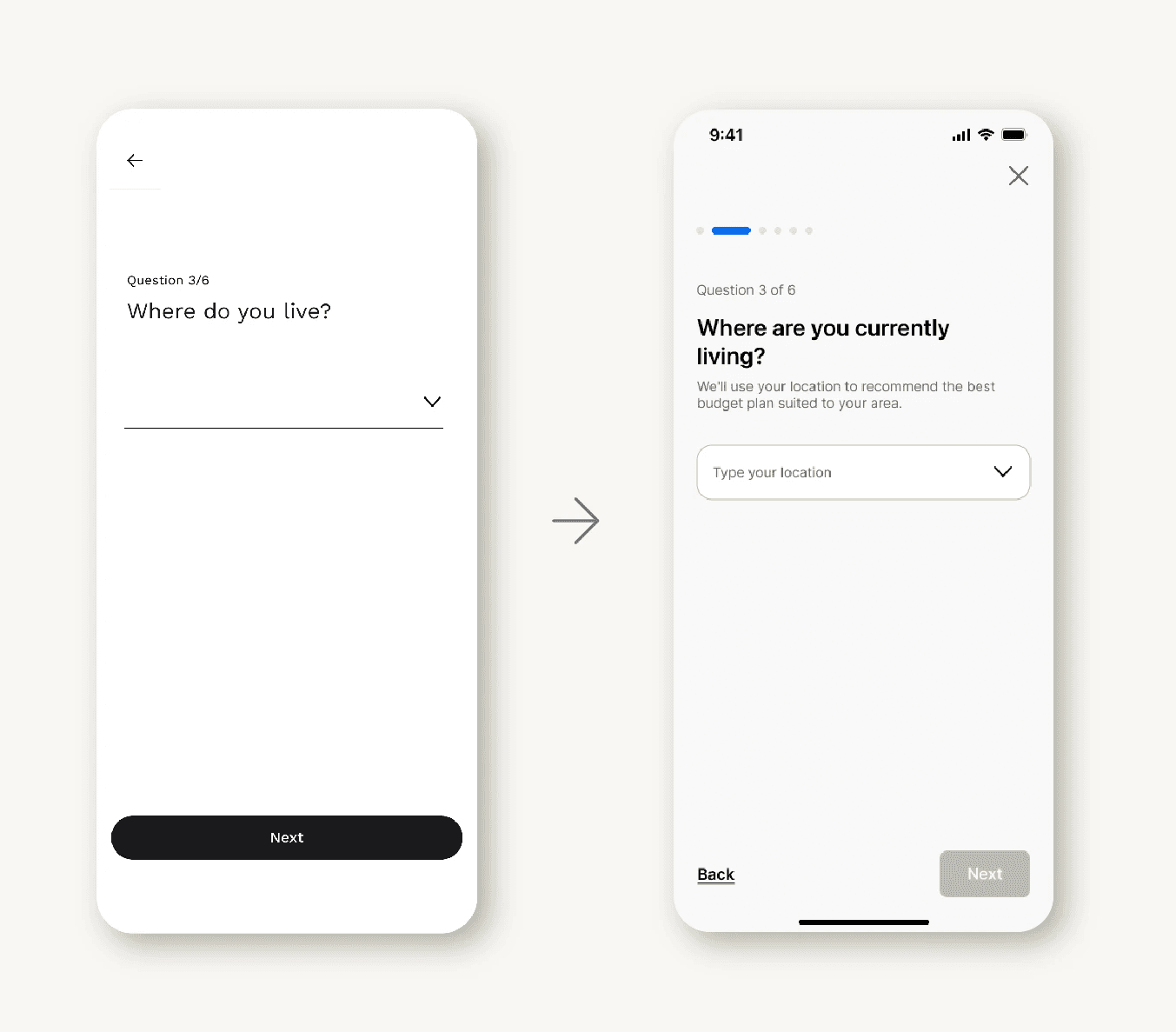

Looking at the iterative process

We had to address the blockers to ensure users would start and continue using the product. Ultimately, we believe these iterations would positively impact the adoption and retention rate.

Clarified onboarding

Being transparent about how users' data will be used to tailor the budget plan.

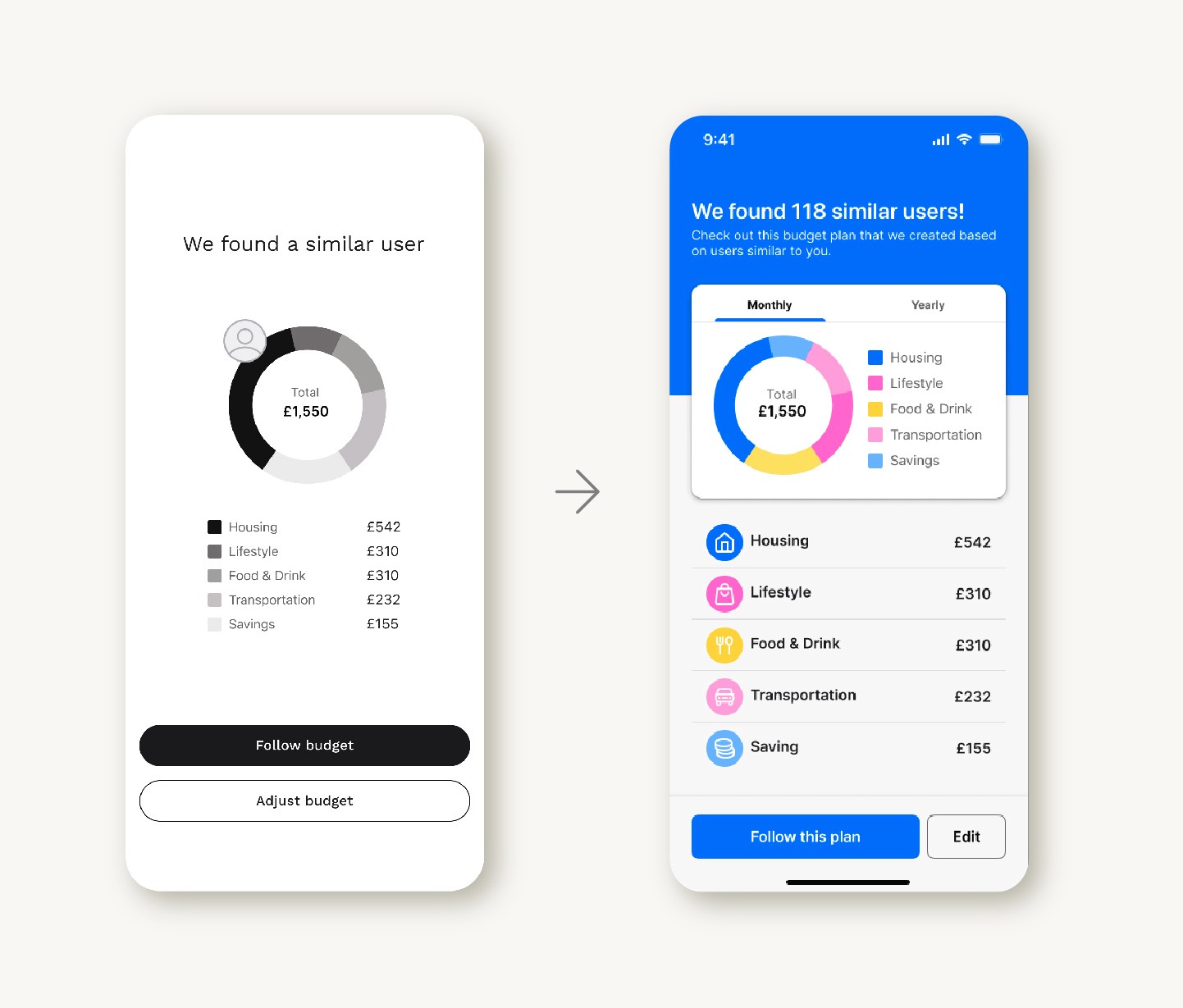

Enhanced product reliability

Emphasising the number of data

Relying on data from only one user to recommend a budget lacks reliability. Therefore, it's crucial to emphasise the number.

Enhanced product reliability

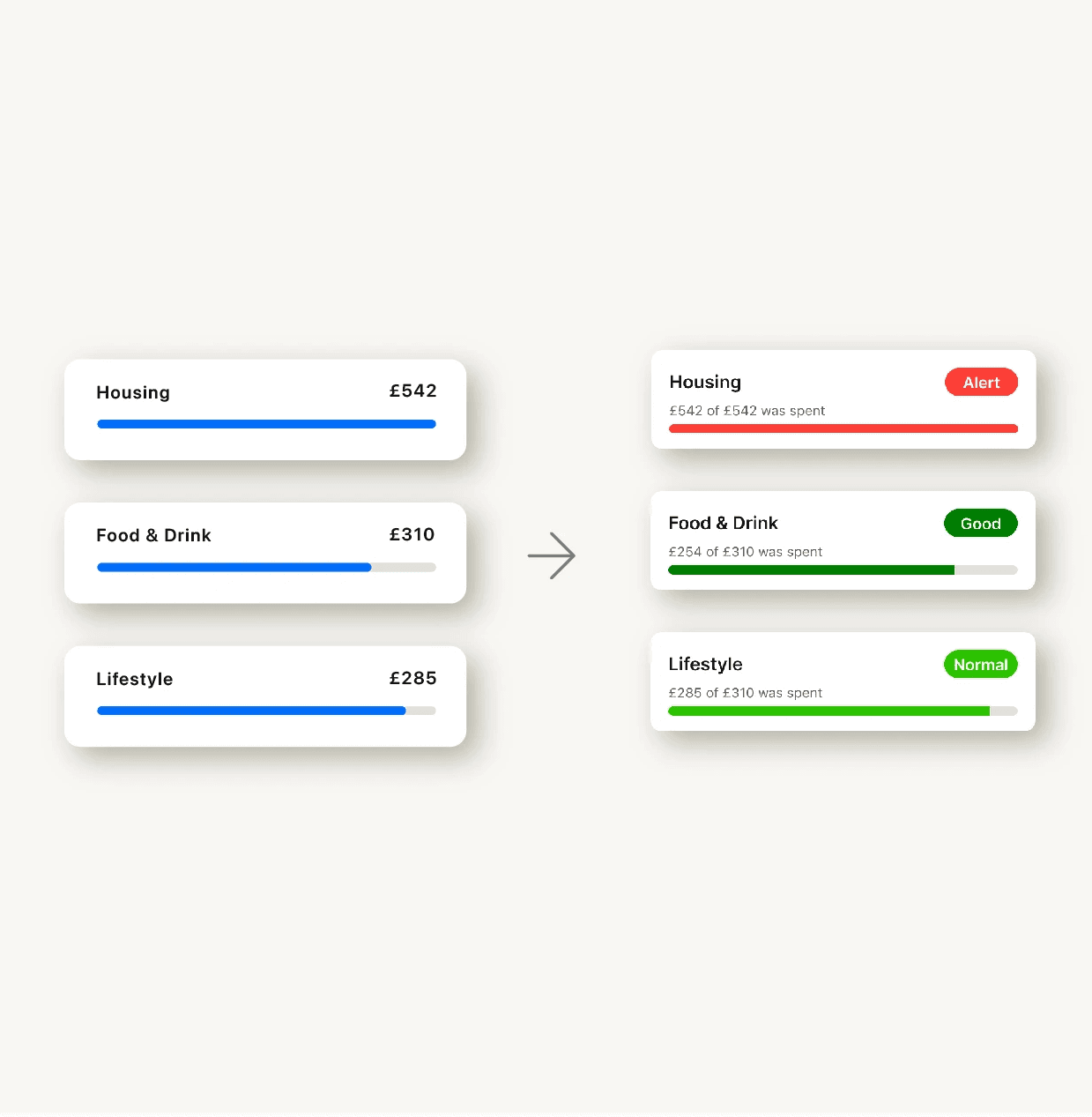

Feedback on user progress

The user couldn't sense the urgency to control their finances daily until it was too late. It's crucial to alert them when they spend too fast.

Increased sense of urgency

The outcome

We evaluated the product with four participants using moderated user testing and SUS surveys to determine the potential impact of our iterations on users' adoption rate.

Outcome

83

Outcome

ꜛ33%

Participant willingness to use the product, as measured by the SUS survey, averaged 4 out of 5. This reflects a 33% increase in the adoption rate compared to the initial design.

What if I have a time machine?

Looking back at it, there are a few things that I would do differently:

🧪

Experiment more

Narrowing in on a single idea too soon can limit our view. Therefore, I would test with at least two potential solutions to ensure we're designing the "right thing".

📢

Early client communication

By involving the client early, potential problems and risks can be identified and addressed at an early stage, allowing us to work more efficiently and agile.

🤏

Design small

I would prioritise the part of the product that can deliver value now without designing the whole thing. This approach can allow us to experiment with more ideas.

💯

Let go of perfection

The major challenge is our limited communication with the client—just one weekly meeting. Furthermore, convincing them of our design decision is challenging without the client's direct involvement in the research process. To overcame this, I've learned to…

Justify design decisions through snackable content (one piece at a time) and storytelling.

Fun fact: people remember stories about people better than number.